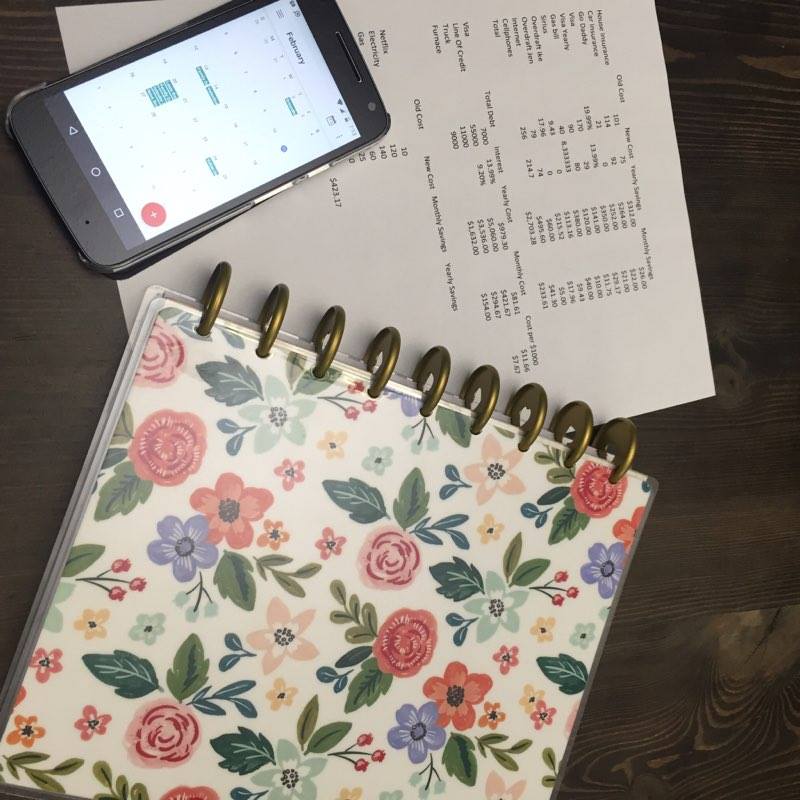

I mentioned in earlier posts that the first step we took to get our finances under control was to scrutinize our regular expenses. Here I will outline what we did. Hope it is helpful. I already talked about GoDaddy and Sirius in previous posts here and here.

|

Old Cost

|

New Cost

|

Yearly Savings

|

Monthly Savings

|

|

|

House insurance

|

101

|

75

|

$312.00

|

$26.00

|

|

Car insurance

|

114

|

92

|

$264.00

|

$22.00

|

|

Go Daddy

|

21

|

0

|

$252.00

|

$21.00

|

|

Visa

|

19.99%

|

13.99%

|

$350.00

|

$29.17

|

|

Visa Yearly

|

170

|

29

|

$141.00

|

$11.75

|

|

Gas bill

|

90

|

80

|

$120.00

|

$10.00

|

|

Sirius

|

40

|

8.33

|

$380.00

|

$40.00

|

|

Overdraft Ike

|

9.43

|

0

|

$113.16

|

$9.43

|

|

Overdraft Jen

|

17.96

|

0

|

$215.52

|

$17.96

|

|

Internet

|

79

|

74

|

$60.00

|

$5.00

|

|

Cellphones

|

256

|

214.7

|

$495.60

|

$41.30

|

|

Total

|

$2,703.28

|

$233.61

|

Just before the new year we received a letter from our insurance broker outlining that they were changing our house insurance provider. The letter talked about how much better this new provider was with customer service, coverage etc etc. It was actually a pretty good effort trying to get us excited about a policy that was $15 per month more expensive. Our house insurance had increased every year by a few bucks and it was time for us to do some shopping. We called Belair, who we insure our vehicle with to get a quote. Not only was house insurance much less for the same coverage, but they also lowered our vehicle insurance premium for having multiple policies with them. Total insurance premium savings is $48 per month.

Next on our list was our Visa bill. I couple years ago we upgraded our Visa to a points card. We figured we may as well get something back if we are going to be using the card anyway. The interest rate was 19.99%, which is pretty standard and the yearly fee is $170 for having 2 cards. We never touched the points, in that time we paid $340 in yearly fees and 19.99% on a $7,000 rolling balance. We realized in the new year that we could use the points to make a payment to the balance. Wow!, we accumulated $425 worth in points. Seems pretty good until we really dug into what those points cost us. I called the bank and changed the card to a regular Visa at 13.99% and $29 yearly fee. If we had done this 2 years ago rather than upgrading to a points card we would have saved $982 in fees and interest.

Ahh, gotta love overdraft. Saves you $45 if it covers what would have been a non-sufficient funds (NSF) charge. The problem is we have been using overdraft as though we actually have that money for years. It has not been used as intended. When looking at the actual cost it also surprised me that we have been spending 36.5% when you include monthly fees. Between both of our accounts we only have $900 overdraft so this is the first debt we own that we are paying off. Make sure that if you plan to do the same, that you call the bank and cancel. Even if you do not go into overdraft, you will continue to be charged the fees of having it available to you.

For our internet service, gas and cell phones, I just called our providers and asked for their help or suggestions to lower the monthly bill. They were all helpful in this.

All in it cost me about 2 hours on the phone to achieve these results. The low hanging fruit has been picked. Now its time for the real work and reducing debt.

Thanks for reading, please leave comments.

Ike & Jen